am i taxed on stock dividends

This includes dividends reinvested to purchase stock. 3 hours agoThe tax code is very generous for dividend-paying stocks.

For Nris Dividend Income Is Taxed At 20

All dividends are taxable and all dividend income must be reported.

. The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. You must report dividend income on your tax return even if you dont receive a Form 1099-DIV for some reason. Even if you reinvest all of your dividends directly back into the same company or fund that paid you the dividends you will pay taxes as they technically still passed through your hands.

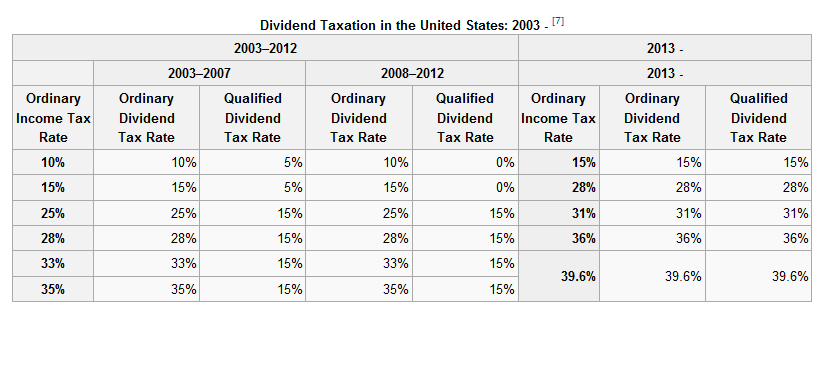

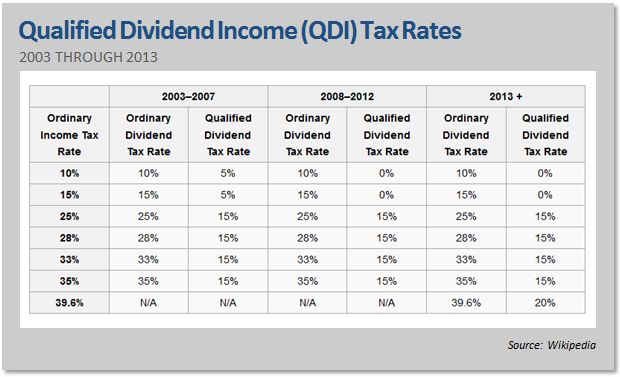

Qualified dividends however are taxed at lower capital gains rates with a maximum of 15 percent. If youre in the 25 to 35 percent tax bracket your qualified dividends will be taxed at 15 percent. The qualified dividend tax rate.

80801 for married filing jointly or qualifying widower filing status. Issuers of corporate securities are required to complete Internal Revenue Service Form 8937 to report organizational actions including nontaxable dividends that affect the basis of the securities involved in the organizational action. For retirement accounts stock dividends are not taxed.

A history of our dividends and required IRS disclosure regarding dividend characterization are outlined below. See capital games for details on current past and future tax rates for reporting gains or losses. According to law dividend tax allowance refers to the amount of tax a dividendsr can earn tax-free.

As of 6th April 2020 you are allowed a dividend tax allowance of 2000 for the 2020-21 tax year this is 6th April 2020 to 5th April 2021. As a resident alien you are subject to the same tax rules as a US citizen if you have a green card or meet the residency requirements. This exemption is forfeited if the company allows the investor to choose.

8 Using Schedule B Schedule B is a supplemental tax form used to list interest and dividend income from multiple sources. Talk 1-on-1 with Tax Advisor Now. Some exceptions for example may include i any stockholder can elect to receive the distribution either in stock or property including cash and ii the distribution is disproportionate.

In general no tax is paid on both capital gains or dividends so long as the stocks are held within retirement accounts. They must be reported even if you reinvest them buying more stock. Common stock PIK dividends generally are not taxable to the recipient under IRC Section 305 unless one of the exceptions applies.

In a bracket above 35 percent. It is taxed at 396 percent for dividends that are not considered to be eligible dividends both numbers are for the highest income tax bracket. Unless you hold your dividend-paying stocks in a.

Dividends are not subject to yearly taxation because they are deposited into a Roth IRA instead. Ad Ex-dividend Date Monthly Did Payments Stock Schedules. If you have qualified dividends and the appropriate paperwork however then your dividend tax is one of three figures 20 15 or nothing at.

Qualified dividend taxes are usually calculated using the capital gains tax rates. However you dont have any control over whether to take a dividend or not like you would if you were merely taking a long-term capital gain in a stock. Unfortunately there is one exception to this rule.

Online 24 Hours a Day. Type of investment account. The dividend payout ratio for AM is.

Dividends are taxable regardless. You may owe tax on dividends earned by stock held in a taxable brokerage account. Ad Be a Smart Taxpayer.

Qualified dividends are taxed at the long-term capital gains tax rate which is typically 15 for most investors. Under current law qualified dividends are taxed at a 20 15 or 0 rate depending on your tax bracket. Qualified dividends are taxed at the long-term capital gains rate of 20 in nonretirement accounts.

For 2021 qualified dividends may be taxed at 0 if your taxable income falls below. To be qualified the dividends must meet certain criteria such as they must be paid by a US. Stock dividends are generally not taxable until the stock is sold.

Additionally to your 132500 personal allowance you will receive this allowance. 40001 for those filing single or married filing separately 54101 for head of household filers or. How Are Dividends Taxed.

The tax rate on nonqualified dividends is the same as your regular income tax bracket. Do non-residents pay tax on UK income. Capital gains taxes are very similar to those incurred when buying United States-domiciled stocks The Canadian government imposes a 15 withholding tax on dividends paid to out-of-country investors which can be claimed as a tax credit with the IRS and is waived when Canadian stocks are held in US retirement accounts.

Corporation or qualified foreign corporation and you must have held the stock for more than 60 days. In a non-retirement account qualified dividends are taxed at long-term capital gains rates depending on your tax bracket federal rates are. Firms are taxed at a rate of 30 for nonresident aliens.

The withholding tax paid to the IRS on dividends from United States businesses is still paid within TFSAs. Dividends handed out by US. You would not owe tax on dividends from stocks held in a retirement account such as a.

Well lucky you but youll have to pay 20 percent on those qualified dividends and long-term capital gains source. Yes the IRS considers dividends to be income so you usually need to pay taxes on them. The general rule for dividend taxation In general dividends are treated as income for tax purposes.

Dividend Tax Rates In 2021 And 2022 The Motley Fool

U S Dividends And The Capital Gains Tax Rate Since 1961 Seeking Alpha

Are Lower Tax Preferred Stock Dividends Really A Better Deal Seeking Alpha

Tax Implications For Indian Residents Investing In The Us Stock Market

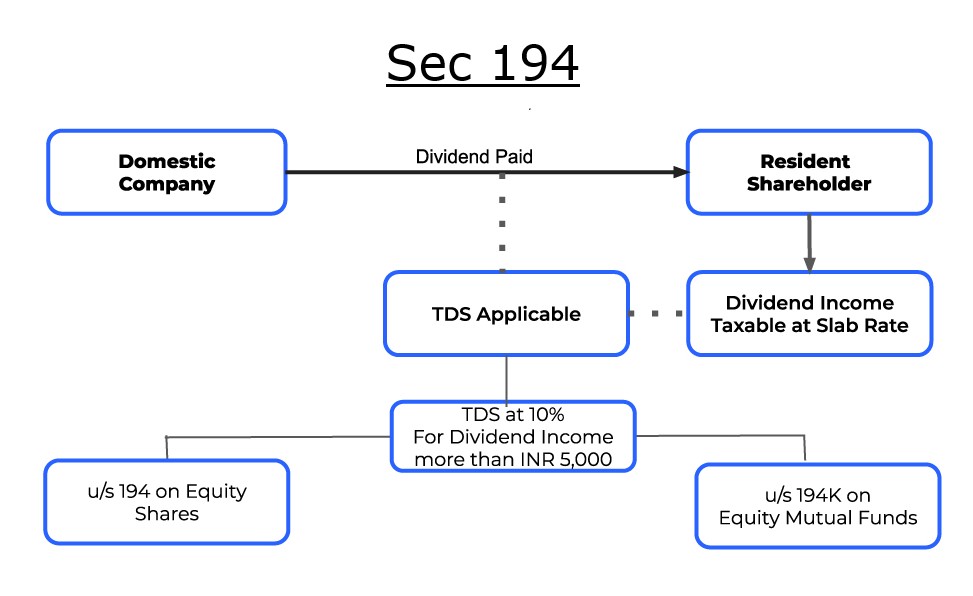

Companies Must Deduct Tax On Dividends

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

All About How Dividends Would Be Taxed From This Fiscal

What Is Investment Income Definition Types And Tax Treatments

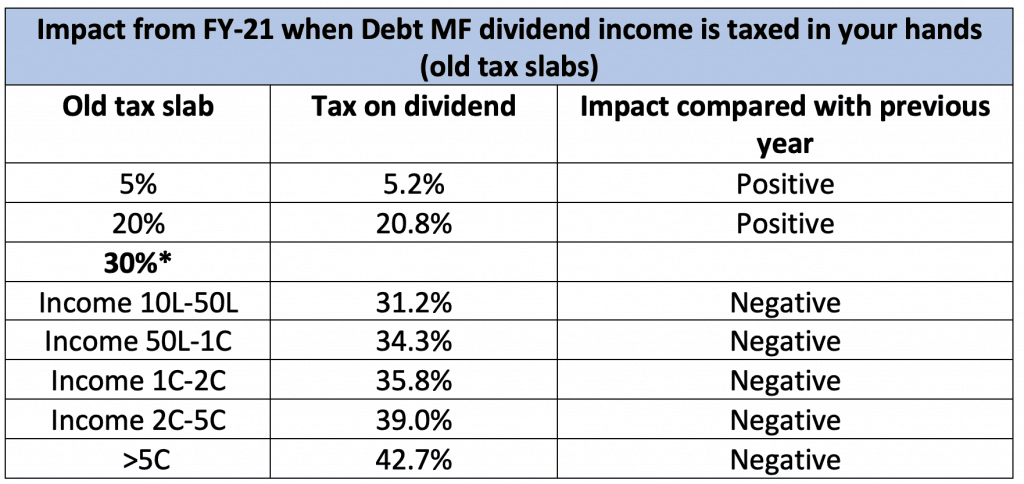

Should You Exit Dividend Options Of Mutual Funds

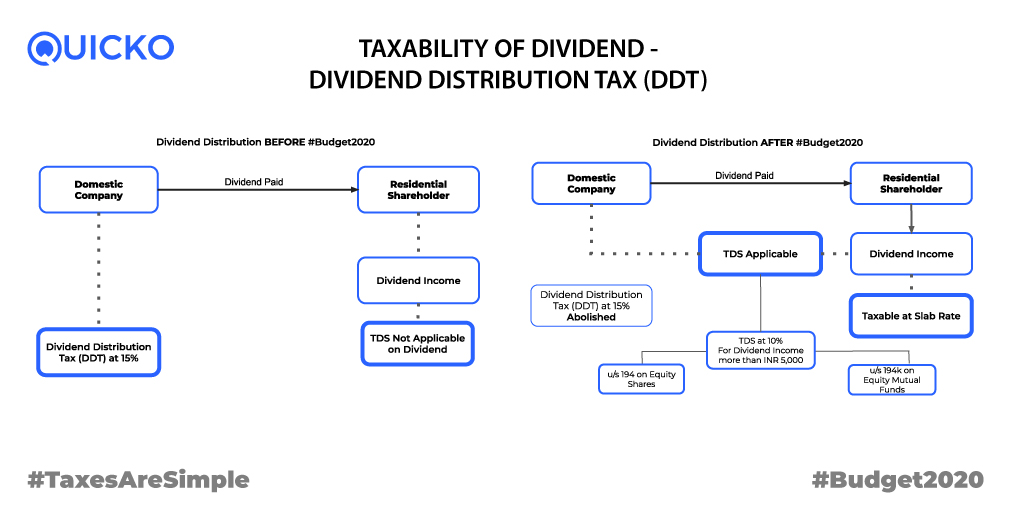

Section 194 Tds On Dividend From Equity Shares Learn By Quickolearn By Quicko

Tax On Dividend Income Taxation On Dividend Income In India Ddt Indmoney

Your Money Know How Dividend Income Is Taxed The Financial Express

Your Queries Income Tax Aggregate Of All Dividend Income Taxable Under Other Sources The Financial Express

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

What Is A Dividend How They Work Who Gets Them Who Pays Them

How Dividend Income Is Taxed In India Now All You Need To Know The Financial Express

Tax On Dividend Income Its Treatment Learn By Quickolearn By Quicko